Financial Targets and Long-term Growth Outlook

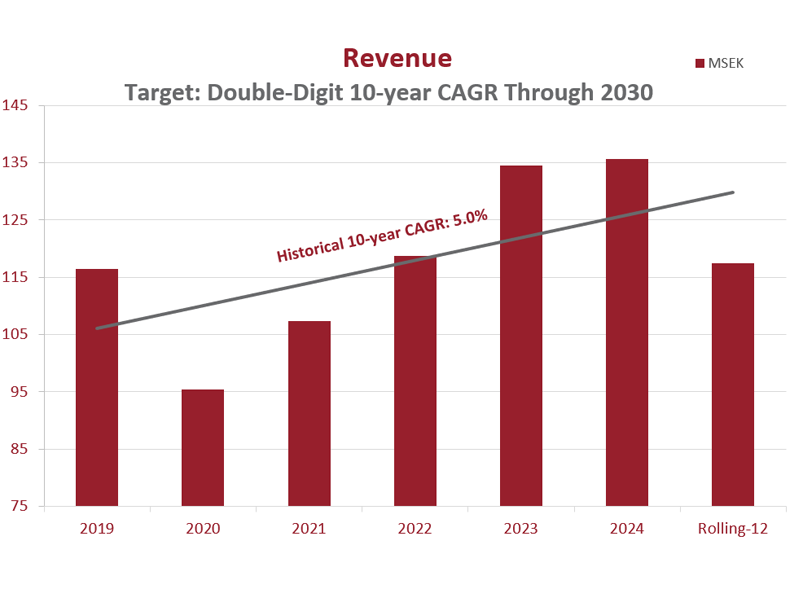

- Double-digit CAGR through 2030

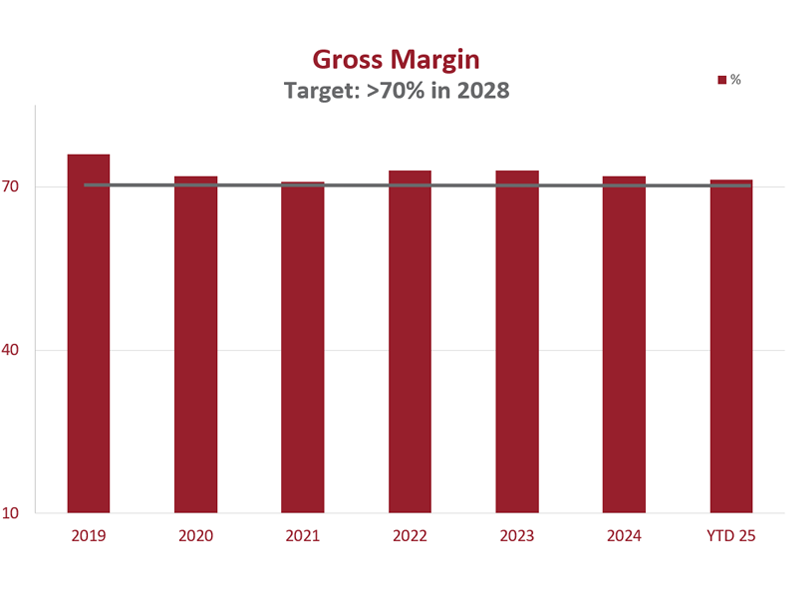

- Maintain gross margin above 70%

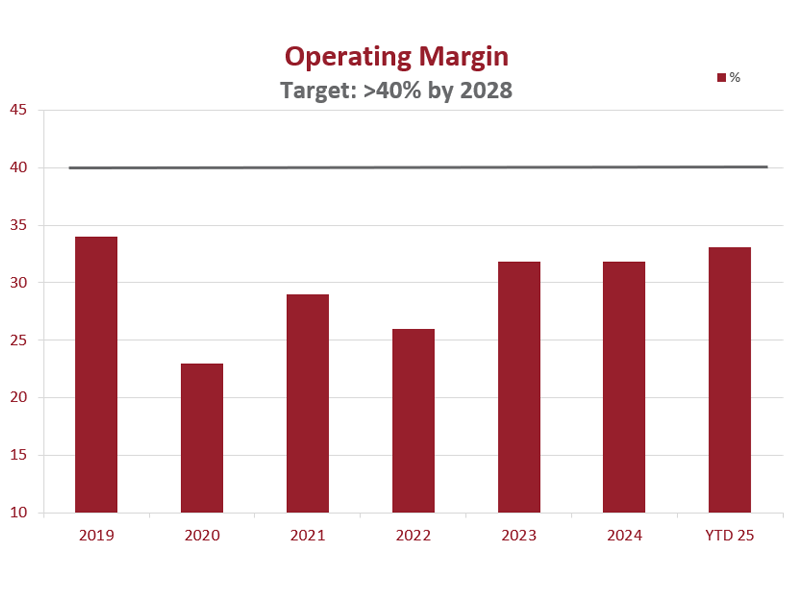

- Increase operating margin to more than 40% by 2028

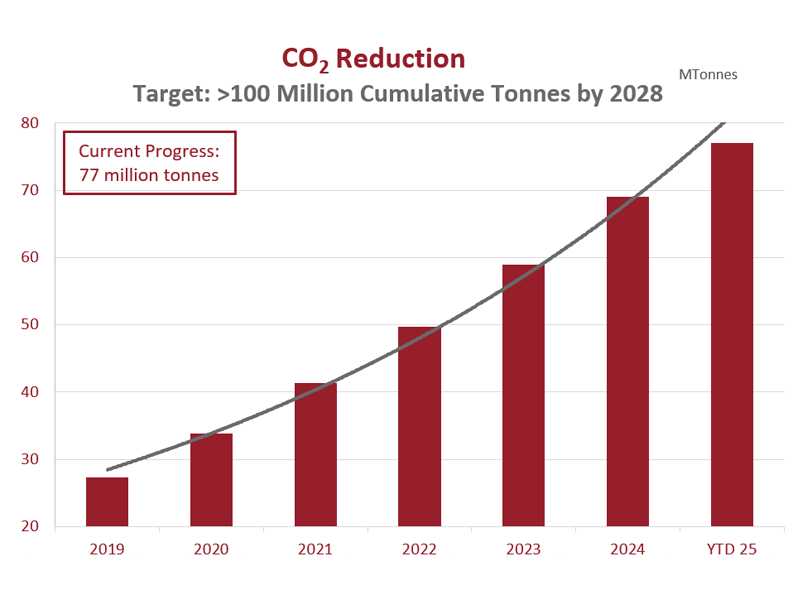

- >100 million tonnes of CO2 reduction by 2028

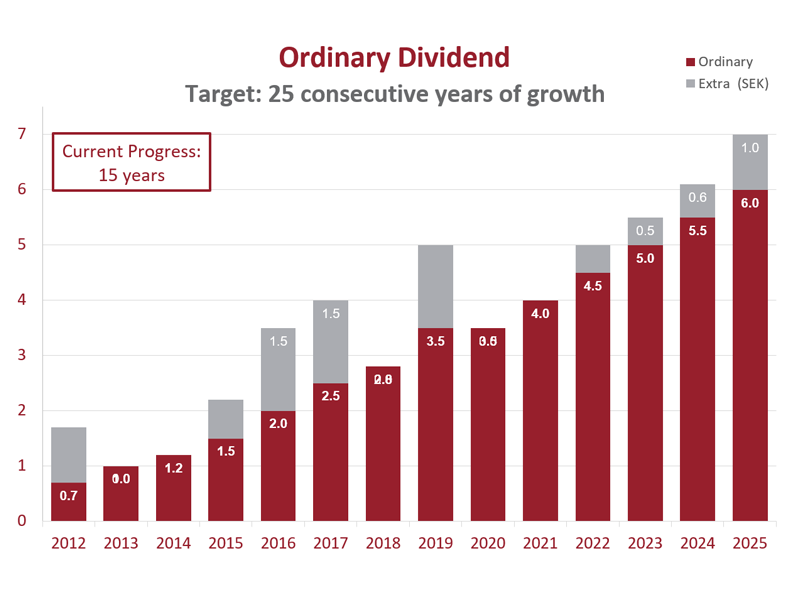

- Extend increasing dividend from current string of 15 years to 25 years

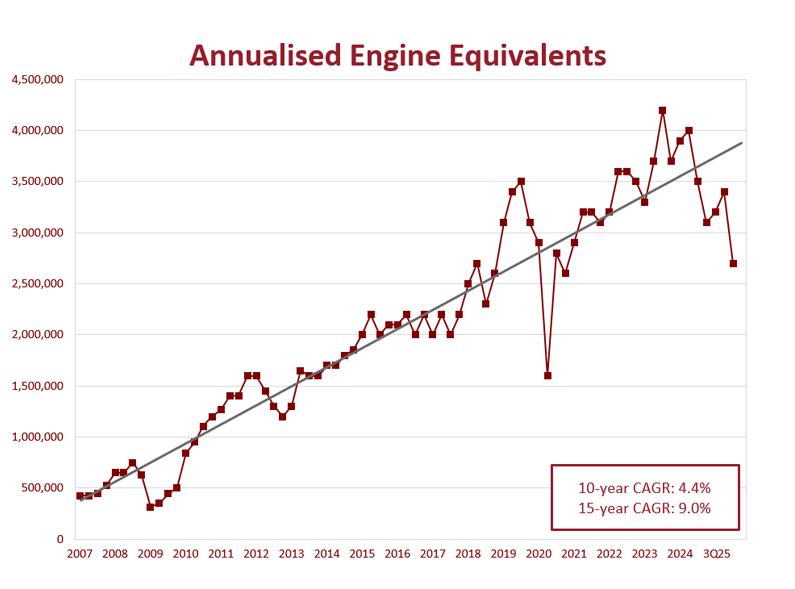

Double-Digit Growth

While SinterCast has historically delivered double-digit compounded annual growth, the current slowdown in series production has reduced the ten-year CAGR to 4.4% and the 15-year CAGR to 9.0%. Benefitting from the strong series production outlook, SinterCast expects to return to double-digit growth when the current cycle recovers. With recurring revenue accounting for more than 90% of the total revenue, SinterCast also forecasts a return to double-digit revenue growth.

Margin Improvement

As a software and service provider, with no in-house manufacturing, the SinterCast business is highly scalable. Historical operating margins have revolved around 30%, depending upon OPEX investments in future growth and R&D. Benefitting from the mature technology, SinterCast foresees reductions in operating costs in parallel with the continued double-digit growth of the series production and the revenue. SinterCast targets to increase the operating margin to more than 40% by 2028. SinterCast will continuously be among the most profitable companies on the Stockholm stock exchange.

CO2 Contribution

Engines that use SinterCast-CGI are smaller, lighter, stronger and more fuel efficient than conventional engines. With more than 90% of our production focussed on commercial vehicles, super-duty pick-ups, full-size pick-ups, and off-road equipment, we estimate that our technology contributes to the saving of approximately 10 million tonnes of CO2 per year. We make large climate contributions to large volumes of large vehicles – today.

Dividend

Since the first dividend was approved for the financial year 2010, SinterCast has delivered fifteen consecutive years of increasing dividend. In total, SinterCast has provided SEK 375 million in dividends, representing more than 110% of the operating result during the same period.