CEO Message

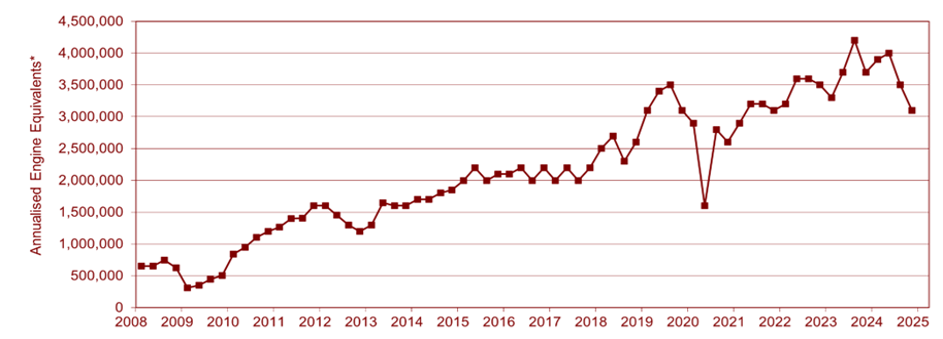

We know from our experience that growth isn’t always a straight line. Following thirteen consecutive quarters of year-on-year growth, spanning from the first quarter of 2021 to the second quarter of 2024, our series production baseline was reset in the second half of the year. Resets are frustrating, but they’re also temporary. With a positive series production pipeline, 2025 marks the start of a new growth phase.

We entered 2024 with a run-rate of approximately 3.8 million Engine Equivalents and an expectation of growth through the first half of the year, benefitting from new commercial vehicle production for MAN in Germany and for First Automobile Works (FAW) in China. But, with the delay in Euro VII emissions legislation in Europe, the Traton Group decided to focus on the production of the SinterCast-CGI 13 litre engine for Scania and Navistar, postponing the rollout for MAN. In China, with the rapid growth of natural gas in late-2023 and early-2024, FAW decided to focus on the ramp of new natural gas offerings, deferring the start of production of our 11, 13 and 16 litre engines. Together, these two decisions changed the complexion of 2024 for SinterCast. We weren’t able to bank enough growth in the first half of the year to offset the known stoppage of a high volume programme during the second half of the year. These product headwinds were exacerbated in the second half of the year by the onset of a slowdown in commercial vehicle sales demand in both Europe and North America. Ultimately, full-year series production finished down 2.7%, from 3.7 million Engine Equivalents in 2023 to 3.6 million in 2024. But more importantly, our annualised run-rate fell from approximately 3.8 million at the start of the year to approximately 3.2 million at the end. It was a frustrating end to a successful run.

Despite the frustrations, 2024 was also a year of progress and achievement. Our work with the automotive OEMs brought new programmes into our series production pipeline, while our efforts in the foundry industry brought new installation opportunities. From July through October, we secured SEK 9 million in new installation commitments, exceeding our historical full-year installation revenue of SEK 8 million. With these orders in hand, we completed installations on three continents in November and December, enabling us to recognise SEK 6.8 million in fourth quarter installation revenue. Our busy fourth quarter installation revenue was higher than five of the last ten full years, pushing our 2024 installation revenue to SEK 11.4 million – our third highest year on record. Ultimately, the strong installation performance enabled us to post record revenue and record operating result for the full year. On the financial side, we demonstrated our frustration – and our confidence – with two share buyback programmes, a record dividend in 2024, and a record dividend proposal in 2025, providing the basis for our fifteenth consecutive year with an increasing dividend. After 33 years in SinterCast, I’ve learned that the frustrating years always need more effort than the good years. We didn’t leave any drops in the 2024 lemon; 2024 is a year that we can be proud of.

Back to Growth

With the resetting of our series production run-rate to approximately 3.2 million Engine Equivalents, it is clear that 2025 will be a year of recovery. But it will also mark the beginning of a new growth campaign that will lead us toward our targets of reaching the five million Engine Equivalent milestone in 2026 and the seven million milestone in 2029. That campaign will benefit from the pent-up ramp of the MAN and FAW commercial vehicle programmes: the delay in those programmes only affected the timing, not the opportunity. The rollout of the Traton Group 13 litre engine to MAN – announced on 27 February 2025 – has the potential to provide incremental production of 500,000 Engine Equivalents per year. Likewise, the FAW 11, 13 and 16 litre engines have the potential to provide 500,000 incremental Engine Equivalents at mature volume. More importantly, the FAW programmes mark our first high volume production in China, providing the opportunity for us to really show the Chinese OEMs how good we are. Today, China represents less than 1% of our production volume. We foresee the opportunity to increase the Chinese contribution to 15% by the end of the decade.

Over the past 20 years, commercial vehicle OEMs have responded to increasingly stringent emissions legislation by increasing the combustion pressure in their engines. The higher pressure improves performance and fuel efficiency, but simultaneously increases the load on the engine components. This trend toward higher pressure has driven the demand for CGI and it will continue to do so. We estimate that 40~50% of the new generation of commercial vehicle diesel engines have already adopted CGI and we expect this to increase to more than 80% by the end of the decade. With commercial vehicles currently accounting for approximately half of our series production volume, this CGI uptake is the basis of our outlook for double-digit growth through 2030. At the same time, we expect that electric trucks will account for less than 10% of the heavy duty market by 2030. The net result – missed by the pundits – is that CGI will grow faster than electrification through 2030.

From Engines to Energy

Commercial vehicle OEMs have championed that their new CGI engines provide approximately 8% better fuel efficiency than the engines they replace. This improved fuel efficiency – in commercial vehicles and pick-up trucks alike – is the root of our climate contribution. With approximately 15 million SinterCast-CGI vehicles on the road, the efficiency of the vehicles that use our technology saved approximately 10 million tonnes of CO2 during 2024. In perspective, our global CO2 reduction offsets approximately 70% of the annual CO2 emissions from the entire Swedish domestic transportation sector. Since the start of our high volume production in 2003, our cumulative saving has reached 69 million tonnes, putting us ahead of schedule to meet our target of 100 million tonnes of CO2 reduction in 2028.

With a track record of climate contribution, we see the era beyond 2030 as the opportunity to make our biggest contribution. With the growing realisation that new technology is rarely fast or easy, the debate is beginning to change from the powertrain (engines, batteries or fuel cells) to the fuel. Benefitting from existing infrastructure for manufacturing, service and refuelling, combined with operator familiarity, payload and total cost of ownership advantages, we believe that the internal combustion engine – with clean, net zero fuels – will be an important part of the long-term solution for sustainable mobility. Whatever the ultimate mix and eventual transitions between hydrogen, eFuels, biofuels, renewable natural gas, renewable diesel and other novel entrants, the base engine will remain predominantly the same. The momentum toward clean fuels is momentum toward SinterCast in perpetuity.

Stay the Path

As I look forward, I like our view. The outlook for series production is positive, with new products coming on-stream in the near term and new programmes under development for the start of production in 2028 and beyond. The overall market outlook is also positive, with the demand for commercial vehicle sales expected to recover during 2025, and with healthy long-term demand fuelled by pre-buys in the US in 2026 and in Europe in 2028. On the installation front, we are poised to deliver a second consecutive year of strong installation revenue, including our first installation in India. And we will continue to benefit from the strong relationships that we have earned in the foundry and automotive industries, growing and reinforcing our leadership position. Internally, I am pleased and comforted by the positive start and contributions that Vitor, my successor, has made and by the way that our experienced team has embraced him. As I approach the start of my final fiscal AGM year, I am entirely confident in our organisation and in our outlook. I have no doubt that our team will achieve the targets we have set, and much more.

Dr. Steve Dawson

President & CEO

Originally published in the 2024 Annual Report.